By

Nze David N. Ugwu

When President Bola Ahmed Tinubu took the oath of office on 29 May 2023, he announced policies that would, in his telling, reset the Nigerian economy: removal of the fuel subsidy, unification of foreign-exchange markets and a determined push to stabilise public finances. The cost of that reset, the administration argued, would be painful in the short term but necessary for longer-term recovery. To soften the blow, the federal government promised — and periodically delivered — cash palliatives and conditional cash transfers to “vulnerable” households.

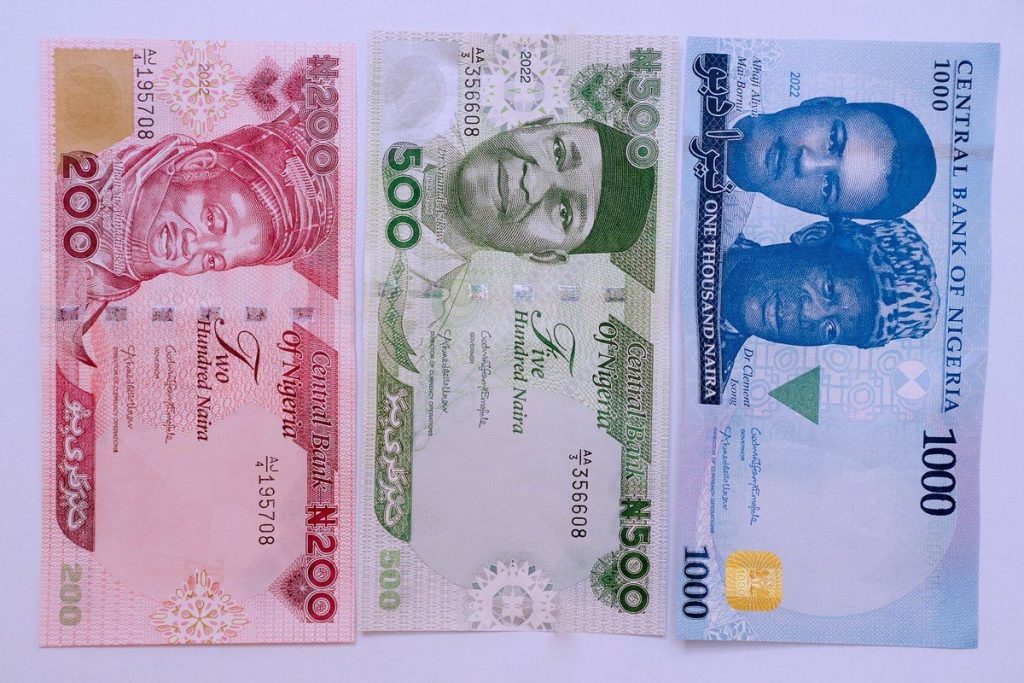

Weeks and months of announcements followed: N25,000 tranches, N8,000 proposals, a N500 billion palliative pledge, World Bank loans earmarked for cash transfers, and, in later phases, plans for larger packages of N75,000 to cover households deemed poor. But despite the noise, ceremonial disbursements and breathless presidential declarations, the central question remains: have these cash distributions meaningfully improved the lives of ordinary Nigerians, or have they been ephemeral gestures — bandages on a wound that keeps widening?

This article examines what the federal government says it has done, what independent evidence suggests, how those programmes have interacted with the broader economy, and whether Nigerians are, in any durable sense, better off than they were on 29 May 2023.

What the government claims it has done

Since 2023 the Tinubu administration has made repeated claims about cash transfers and the scale of palliatives. In public addresses and press statements the presidency has cited hundreds of billions of naira disbursed under social investment programmes. As recently as mid-2025 the presidency and government officials pointed to cumulative disbursements and ongoing plans to reach millions more households. One frequently quoted official figure is that the government has disbursed about N330 billion to roughly eight million vulnerable households under its social investment programmes.

Beyond outright disbursements, the administration secured major multilateral financing intended to support cash transfers and social protection. The World Bank and other partners approved multi-billion-dollar facilities to help shore up Nigeria’s reform programme and to finance social safety nets — a recognition by external funders that reforms such as subsidy removal would create near-term hardship that needed cushioning. The World Bank’s broader support package — referenced publicly by the Bank and reported widely in the press — included hundreds of millions of dollars intended for cash transfers to expand coverage of vulnerable households.

The presidency has also announced successive headline palliative packages — the early N25,000 monthly tranches for millions of households (sometimes presented as N25k plus a temporary extra), proposals for N8,000 monthly emergency transfers that were reviewed after public outcry, and later plans to distribute larger single sums (e.g., proposals for N75,000 per household as part of a scaled cash-transfer push).

Taken together, the government’s narrative is straightforward: reforms were necessary, hardship followed, and cash transfers and palliatives were the instrument chosen to reduce immediate suffering while the economy rebalanced.

The transparency problem: where is the proof?

If government pronouncements are to be believed, large sums have been disbursed and millions of households have been reached. But volume of rhetoric is not the same as verifiable impact. Two interlocking problems plague the official story.

First is transparency. Repeatedly, citizens, journalists and civil-society groups have demanded lists of beneficiaries, disaggregated payment records and audited trail-records to show money reached named households. Those demands have often been met with partial answers, selective summaries or high-level statements rather than full, independently verifiable ledgers. That gap has fuelled scepticism and the perception that much of the palliative narrative is performative. Calls for publication of beneficiary lists — the simplest form of verification — have been loud and recurrent.

Second is coverage versus adequacy. Even when payments have been made, the sums are modest relative to cost-of-living increases. A once-off N25,000 payment or even a short series of small monthly transfers cannot realistically substitute for lost purchasing power where inflation has eroded incomes and food and transport costs have risen steeply. That leaves many recipients short of the real support they need, and leaves non-recipients resentful and excluded.

The combination — limited independent verification and transfers that are small relative to inflationary shocks — makes it difficult to conclude that these programmes, as designed and implemented so far, have produced durable improvements in living standards.

The macro picture: palliatives in the context of reform

To evaluate the impact of cash distributions, they must be assessed within the broader economic trajectory set by the administration’s reforms. Three features are central.

- Subsidy removal and price effects. The administration moved decisively to end decades of fuel subsidy. While economists had long argued subsidy removal was fiscally necessary, the immediate effect was a sharp rise in domestic fuel prices and, through transport and input costs, a broad pass-through into consumer prices. Multiple studies, monitoring reports and public-opinion surveys documented that the subsidy exit contributed to higher inflation and a tougher cost of living for households. The World Bank and other observers emphasised that expanded social protection would be needed to mitigate those effects.

- Exchange-rate and monetary policy shifts. The unification of multiple foreign-exchange windows and other market reforms altered price signals across tradable goods and services. Those moves stabilised certain macro variables and encouraged capital inflows at times, but they also produced competitive pressures on incomes and on firms that depend on imported inputs.

- Borrowing to pay for social protection. The federal government leaned on borrowing and donor programmes to fund palliatives (for example, World Bank facilities were explicitly cited as part of the finance package for expanded cash transfers). Borrowing for recurrent support raises longer-term fiscal questions if the transfers do not transition into sustainable, domestically financed social systems.

Palliatives, then, operated as emergency relief embedded in a wider economic reform architecture that itself produced the initial pain. That dynamic explains why palliatives can look simultaneously generous in headline sums and ineffectual on the ground: the underlying macro drivers were large and structural, while the relief measures have tended to be temporary and partial.

What the data and independent reporting show about outcomes

Two practical measures matter most to ordinary Nigerians: (a) whether real incomes and consumption improved, and (b) whether poverty and food insecurity fell.

Independent polling and research since 2023 paint an uncongenial picture. Opinion surveys and dispatches indicate that a majority of Nigerians believe the country is headed in the wrong direction and continue to oppose subsidy removal on the grounds that it worsened living standards. Afrobarometer data and other public-opinion instruments recorded widespread perceptions of economic decline, and many households reported increased hardship and difficulty meeting basic needs.

Academic and policy research examining the immediate consequences of subsidy removal and reform measures found a short-to-medium-term rise in prices for transport, food and utilities, and a consequential squeeze on household purchasing power. In other words, the macro reforms did not reduce hardship quickly; if anything, they exacerbated it before any medium-term benefits could materialise.

On the social-protection front, reporting shows both scale and limitations: large sums have been committed and some payments have been made, but delivery has been uneven and many eligible households report not receiving anything. Journalistic probes and civil-society checks have flagged distribution bottlenecks, identification and targeting problems, and instances where payments arrived in only one or two tranches rather than the full promised amounts. This mixture of partial payments and uneven coverage explains why a presidential announcement of “N330 billion disbursed to 8.1 million households” can coexist with widespread public complaints that “where’s the money?” and “I did not get paid.”

Distribution mechanics and the politics of targeting

Two technical problems matter for whether cash transfers can work: targeting (who gets the money) and delivery (how money gets to people).

Targeting in Nigeria has relied on a mix of existing social registries, NIN (National Identification Number) linkages and ad hoc lists generated at state or local levels. Each of these is imperfect. Social registries are incomplete; NIN coverage is high in urban areas but lower in underserved communities; and local political dynamics sometimes distort beneficiary lists. The result is leakage (payments to people who are not the poorest), exclusion errors (poor people left out) and politicised roll-outs where patronage can influence who appears on beneficiary lists.

Delivery channels — banks, mobile money and agency networks — improved over time, but not uniformly. In areas with limited banking infrastructure or weak telecom connectivity, conditional cash transfers encounter friction; in urban areas with better infrastructure, payments are easier to process. Where delivery systems fail, intended recipients may never receive funds, or they may receive lower effective amounts after paying intermediaries or incurring travel and transaction costs.

These technical headaches are not trivial. A well-designed, well-targeted, reliably delivered cash transfer can provide substantial relief and can be a foundation for longer-term social inclusion. But what Nigeria’s experience has shown so far is that design and implementation constraints — plus weak transparency — undermine credibility and blunt impact.

The limits of palliatives as policy

Palliatives have three inherent limitations worth emphasising.

- They are temporary by design. Cash transfers designed as emergency relief relieve immediate distress but do not alter underlying vulnerabilities — lack of jobs, low agricultural productivity, broken value chains, weak service delivery and persistent inflation. Unless transfers are complemented by structural policies that create sustainable livelihoods, palliatives merely postpone deeper pain.

- They can create moral-hazard expectations. Repeated short-term distributions without a clear, public transition plan to sustainable social protection can produce political volatility: recipients grow dependent on sporadic disbursements and the public grows cynical when the flow dips or lists are opaque.

- They risk fiscal crowding. Financing recurrent cash transfers through loans and temporary budget reallocations is feasible in the short run, but not indefinitely. If transfers become permanent without corresponding revenue measures or reprioritisation, they can crowd out investment in public goods that also reduce poverty (health, education, infrastructure).

The implication is straightforward: palliatives can and should be part of a policy toolkit, but they cannot substitute for a coherent strategy to revive employment, control inflation, stabilise incomes and rebuild public service capacity.

Have Tinubu’s policies improved lives since May 29, 2023?

The question the headline asks — “Are Nigerians any better today than they were on 29 May 2023?” — is both empirical and normative. Empirically, the short answer is: not in any broad or durable sense that most citizens will recognise. Many macro variables that matter for investment, external balances and fiscal health show signs of adjustment and occasional improvement; but the everyday reality for millions — whether they can buy a sack of rice, pay school fees, afford transport to work or meet medical bills — has in many cases deteriorated or at best oscillated.

Surveys and research gathered since 2023 record rising perceptions of hardship and declining confidence in the direction of the country. Many households report increased food insecurity and fewer real income gains; informal workers and low-income households have been particularly hard hit by price increases and transport cost inflation. Where transfers reached people, they sometimes provided a short breathing space, but rarely enough to change overall living standards.

That is not to say there have been no wins. Some reforms — exchange-rate unification, efforts to attract foreign investment, or steps to tackle leakages in some public expenditures — may, if sustained and improved, increase growth and government revenue in the medium term. Some infrastructure projects and administrative reforms may reduce costs for business and improve service delivery. But those are medium-term or longer prospects; for many citizens the immediate timeline that matters is months, not years, and on that measure the balance sheet remains unfavourable.

Where the policy must go: from ad hoc palliatives to durable protection and growth

If cash distributions are to move from political patchwork to genuine poverty-reduction instruments, three broad changes are essential.

- Full transparency and independent auditing

Publish verifiable beneficiary lists (with appropriate privacy safeguards), reconciled payment records and third-party audits of disbursed sums. The simplest credibility step is a public, verifiable ledger that shows who received what and when. Without this, scepticism will persist and political costs will increase.

- Improve targeting and delivery systems

Invest in a robust national social registry tied to identity and means-testing that reduces both leakage and exclusion. Strengthen digital payment rails, mobile money penetration and off-grid delivery options for rural areas. Expand third-party grievance redress and monitoring so errors can be corrected quickly.

- Link transfers to growth and human capital

Cash transfers must sit atop a platform of policies that create jobs and improve incomes. That means accelerated, well-targeted investments in agriculture (to lower food prices and raise farm incomes), technical and vocational training (to plug the skills gap), and public works or wage subsidies where they can be job-creating. Transfers that are conditional on health, education or entrepreneurship training are not a panacea, but when paired with credible opportunities they can raise productivity rather than merely sustain consumption.

- Fiscal realism and domestic financing

Donor or concessional lending can seed programmes; long-term financing must be domestically sustainable. That implies better tax administration, elimination of wasteful expenditures, and careful reprioritisation of budgets to protect both social spending and capital investment. Social protection that competes with infrastructure investment without a plan for revenue sustainability creates a zero-sum game.

The politics of empathy: why palliatives matter beyond economics

Beyond the ledger and the macro data, palliatives have political and social significance. A government that pursues reforms while visibly cushioning the most vulnerable is better positioned to sustain difficult but necessary policies. Conversely, reform without credible protection corrodes legitimacy, invites social unrest and deepens polarisation. The Tinubu administration’s frequent, sometimes haphazard palliative announcements reflect an awareness of this political reality — but rhetoric must be matched by durable systems that citizens can trust.

Conclusion: bandage or beginning?

The federal government’s cash distribution programmes have been — in practice — a mixture of genuine relief, political signalling and uneven implementation. They have provided temporary succour to some households, but they have not yet produced a structural improvement in the welfare of most Nigerians. The scale of the economic shock unleashed by subsidy removal, exchange-rate reforms and global pressures has outstripped the one-off and short-term transfers that were delivered so far. To borrow the metaphor the title uses: the government has placed bandages on an actively bleeding wound. A bandage helps a little and can prevent a worse outcome, but a bandage is not a cure.

If the goal is to convert temporary relief into lasting gain, the administration must move from episodic cash handouts to a coherent, transparent and sustainable social-protection architecture — one integrated with growth policies that expand jobs, stabilise prices and rebuild public services. Absent that shift, palliatives will remain a policy of short breaths, not long-term recovery.

Nze David N. Ugwu is the Managing Consultant of Knowledge Research Consult. He could be reached at [email protected] or +2348037269333.